Month-end close is one of those processes that quietly defines the health of a finance function. To most CPA firms, CAS practices and SMB finance teams, the close is not just about coming up with financials but demonstrating reliability, compliance, and decision-making readiness. However, when you query most of the companies on the duration of their close cycle, the figures you will be told are between 8 and 12 days. Almost half a working month in reconciliations, accruals, and adjustments, which is little time to waste analyzing or working on the future.

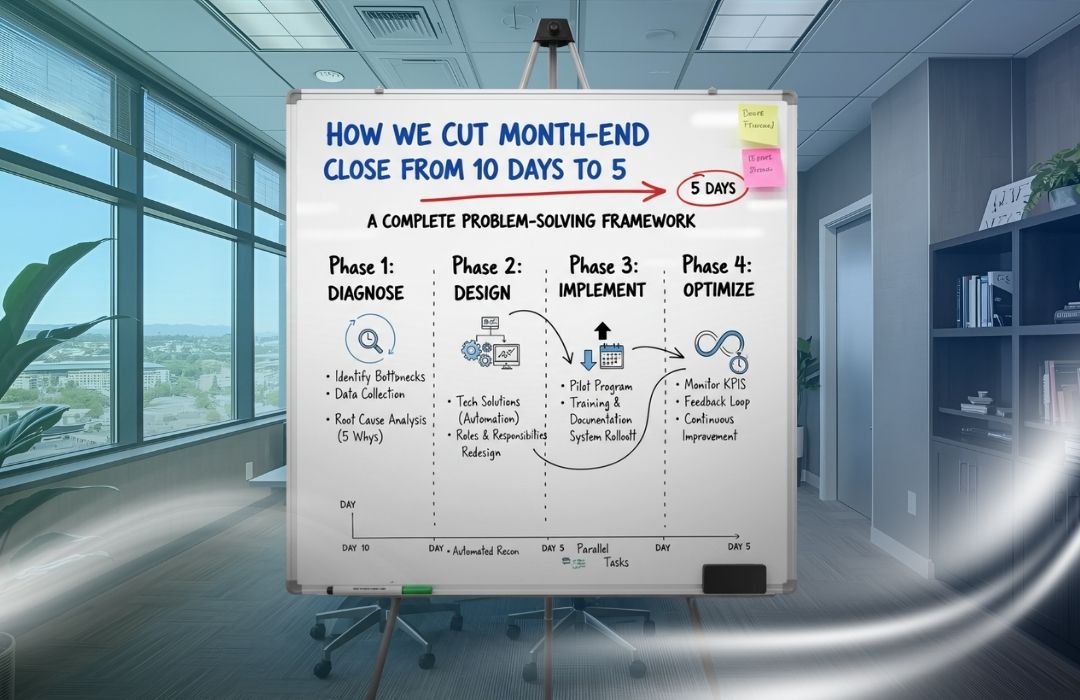

It is not the issue of not working. Staff are operating in the late hours of the night, trying to get approvals and balance figures. The problem lies in the existence of outdated procedures, a lack of visibility, and manual interference, which cause extra friction. This was the issue that we had to overcome in our firm. The deadline for closing at the end of the month was extended by 10 days, resulting in a postponement of reporting, which was depleting the employees. That very process can now be completed in five days only–and without less accuracy, compliance, and audit readiness.

A step-by-step account of how we made it is presented in this blog: the bottlenecks we resolved, the playbook we established, the tools and automations we implemented, the controls that guaranteed quality and the case study that it works. When you are tired of having a month-end that seems like a marathon, keep reading; we will tell you how to reduce it by half.

Why Month-End Close Take Too Long?

The initial move to resolve the close problem is to recognize why it is always taking longer than it ought to. Most finance teams figure that 10+ days is the new normal, but in practice, most of the delays arise due to bottlenecks that reoccur and which can be removed through improved structure and technology.

Waiting on accounts payable (AP) is one of the largest fraud risks. The invoices of the vendors are received at the end of the month, and the approvals lie in inboxes, postponing accruals and reconciliations. Manual accruals are the other typical drag. To calculate and post journal entries manually, teams spend hours in search of supporting documentation that may be in different departments. This not only causes delay but also increases the possibility of error.

Then, there are late/incomplete bank feeds. When banks or credit cards do not automatically reconcile their transactions, employees have to wait until the statements arrive, and in most cases, the gap between them is two or three days.

Here Is What Slows the Close:

Most firms are unable to achieve less than 10 days, and it is not due to laziness, but rather the process. The month-end close is an interdependent set of tasks, and once one aspect is delayed, the rest come to a standstill. The largest criminals we know are these:

- Waiting on Accounts Payable: There is a late arrival of vendor invoices, slow approval and accruals are delayed to the last minute. This postpones the expenses reporting and turns Day 1 into a madhouse.

- Manual Accruals: The absence of automated rules or standard cutoffs results in accountants taking hours to search emails and spreadsheets to record expenses.

- Late Bank Feeds: When transactions are not updated daily, the reconciliation will accumulate, and the team will have to work on weeks of data at a time.

- Reactive Reviews: When reviewers intervene too late, mistakes are revealed too late and must be redone several times, which is even more likely to push the deadline.

These problems may not seem to be catastrophic on a personal scale. However, when put together, they are days of wasted time, duplicated effort and stressed-out teams.

The 5-Day Close Playbook

We achieved a 5-day close by working smarter, not just harder. Our playbook is organized around predictability, accountability, and clarity.

-

A Close Calendar Anybody Can Read

We also post a common calendar with deadline dates for AP cutoff, AR reviews, reconciliations, accruals, variance checks, and reporting, rather than an unclear end-of-the-week deadline. It is not guesswork, and people know what they are expected to do at what time.

-

Mapping Dependencies In Advance

Other tasks may not begin until others have been completed – accruals following AP, bank recs following feeds, variance analysis following reconciliations. Mapping of dependencies helps us to identify critical-path items and follow them up to prevent bottlenecks.

-

Clear Role Assignments

We delegate tasks according to the roles, not only according to the individuals:

- AP Lead – invoices + cutoff compliance.

- AR Lead – receivables + collections.

- Reconciler – Bank, loans, credit cards

- Reviewer – accruals approvals + reconciliations.

- Reporting Owner – assembles and disseminates final reports.

This removes duplication, lack of accountability and moments of I thought somebody had it.

-

Hard Cutoffs That Stick

The fundamental changes of discipline: strict dismissals. Vendor invoices not received before Day 1? They roll to next month. Adjustments on payroll after the cutoff? They wait. When teams become accustomed to this, the end of chaos is no more.

-

Sample 5-Day Timeline

| Day | Focus Area | Tasks Completed |

| 1. | AP & AR | Work on finalizing invoices, accruals, and receivables |

| 2. | Bank Reconciliation | Work on posting transactions, match feeds, and reconcile cash |

| 3. | Balance Sheet Items | Reconcile payroll, loans, and credit cards |

| 4. | Variance Analytics | Compare actuals vs. budget/prior. |

| 5. | Review & Reporting | Reviewer signoffs, distribute financials |

The Automations and Technology Stack

We could not have a 5-day close working with spreadsheets. Here’s the stack we use:

- QuickBooks Online or Xero: Used for core accounting, which is cloud-based.

- BILL: Get automated AP approvals, invoice capture and payments.

- AI-assisted checks: flags replicate or weird records prematurely.

- Daily bank feeds + auto-recs – keep reconciliations up to date continuously.

Automation has a 70-80% real-time work done rather than saving it to be done at the end of the month. By Day 1, we’re already ahead.

Wrapping Up

The act of closing the books should not be like a marathon every month. When you continue to spend 10 days at the end of your month, you are not only wasting time, but also the head of days, sharpness, and chances to make more effective business decisions. By reducing the nearly 5 days or so, you will provide the space to plan ahead, receive quicker reports, and reduce the stress experienced by your team.

It involves a change in structure and discipline, including establishing a calendar, implementing cutoffs, clarifying ownership, and automating processes where it is most critical. Increase strong controls, and you not only speed the process up, but also ensure accuracy and compliance.

The best part? You will never get your team to long to the old system of doing things when they see how much easier and quicker it can be to close. It is a change that will be rewarded each and every month.

We will assist in streamlining your close process with established workflows and technology support, provided you are willing to implement these changes.

Email:

Schedule a Call: