Our

Outsourced Bookkeeping has been a trusted partner for U.S. businesses across industries for a long time:

Real Estate & Property Management

We help with managing accounts payable, CAM reconciliations, tenant ledgers, and vendor management, etc. for operators of multiple properties.

Healthcare & Pharma

We manage HIPAA-compliant billing, payroll, and vendor payments well.

Hospitality & Restaurants

We help you to accomplish inventory controls, expense tracking, and also POS integrations.

Professional Services & CPAs

We help CPA firms serving multiple clients by providing White-label outsourced accounting solutions.

We combine strong industry knowledge with smart AI accounting technology. This helps us provide bookkeeping and accounting services that are accurate, safe, and can grow as you need.

Our credentials include

Our Complete

We offer bookkeeping and accounting services and have local CPA experts in the USA. Our AI accountants use the newest technology for better efficiency. We also have a reliable and budget-friendly offshore team that gives tailored solutions for your business needs.

We provide the following services in financial management:

Bookkeeping

Daily, weekly and monthly bookkeeping to make sure that you have your financial records right and relevant.

Accounts Payable (AP) Management

Now you can keep a track of vendor and utility bills, like water, sewage, and property taxes, from online sites. This helps you avoid late fees and drawbacks. This also helps your team focus on more significant work instead of just managing all the bills. This way you can automate vendor payments and track expenses to keep cash flow stable.

Accounts Receivable (AR) Management

Effective invoice management and quick collections to make the most of revenue.

Payroll Services

Sound payroll operations and remittance of taxes.

Tax Preparation and Filing

We pay attention to federal, state, and local taxes. This helps reduce risks and makes sure your tax returns are done on time.

Controller- CFO-Level Services

Long-term financial management, budgeting, predicting and growth recommendations.

Financial Reporting & Analysis

Customized reports and analysis to aid in making best business verdicts.

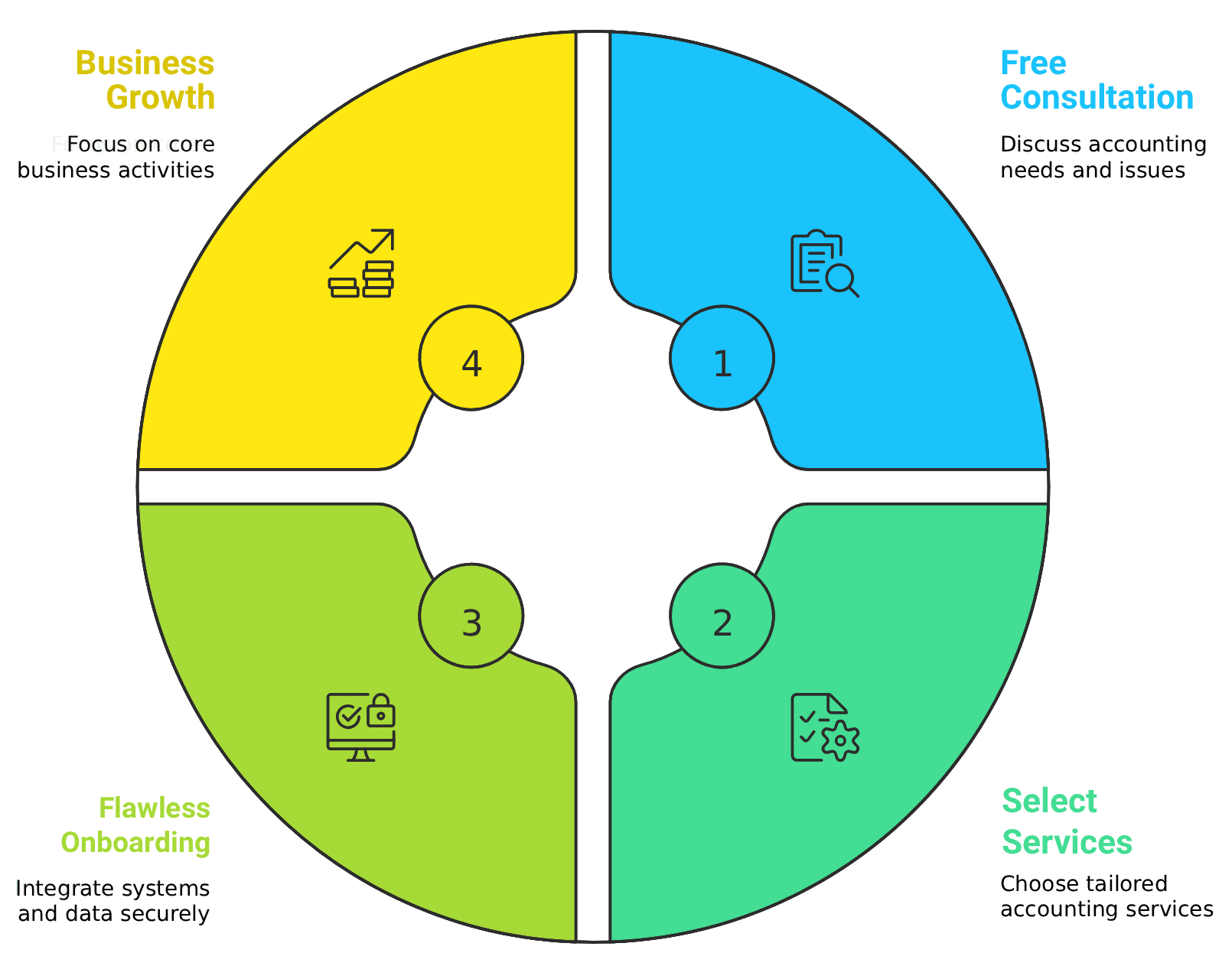

How to

utsourcing accounting services is hassle-free, and it is easy to start. We help you make the transition smooth. You can focus on growing your business while we manage your financial transactions.

Wrapping Up

Accounting outsourcing is not just a cost-cutting strategy, but also a growth, efficiency, and financial insight-driven action.

When you choose Outsourced Bookkeeping, you get a team of certified experts. They are well-versed with QuickBooks, Xero, and Bill.com, and also have more than 2 decades of experience. Get ISO 27001-certified data protection to keep all the information secured.

Our easy-to-use solutions ensure your bookkeeping, payroll, taxes, and financial reports are made accurately and on time. This means you can focus on growing your business.

Outsourcing your accounting provide you the tools which helps in making smart decisions for business. It helps you follow all the rules and manage your finances well. You get real-time information, assurance that you are compliant, and the chance for future profits.

Book your free consultation