Online Payroll Service for Small Businesses Outsourced Bookkeeping

Simplify the Complex Task of Payroll Processing & Ensure Timely Payments

Managing payroll can be complex and time-consuming for small businesses. As one of the best payroll service providers, Outsourced Bookkeeping offers affordable and reliable online payroll services to ensure accuracy, compliance, and timely payments.

Software That We've Worked On

Streamline Your Financial Process with Fully Managed Payroll Services

Outsourced Bookkeeping adheres to necessary rules and policies along with keeping track of allowances and deductions. We guarantee accuracy and compliance at every step of payroll processing.

Small businesses often face challenges like limited resources, tax compliance, and payroll errors. Our payroll service for small businesses eliminates these concerns by providing automated calculations, tax filing, and direct deposit solutions.

Services

Get Weekly, Bi-monthly, or Monthly Payroll Management Services

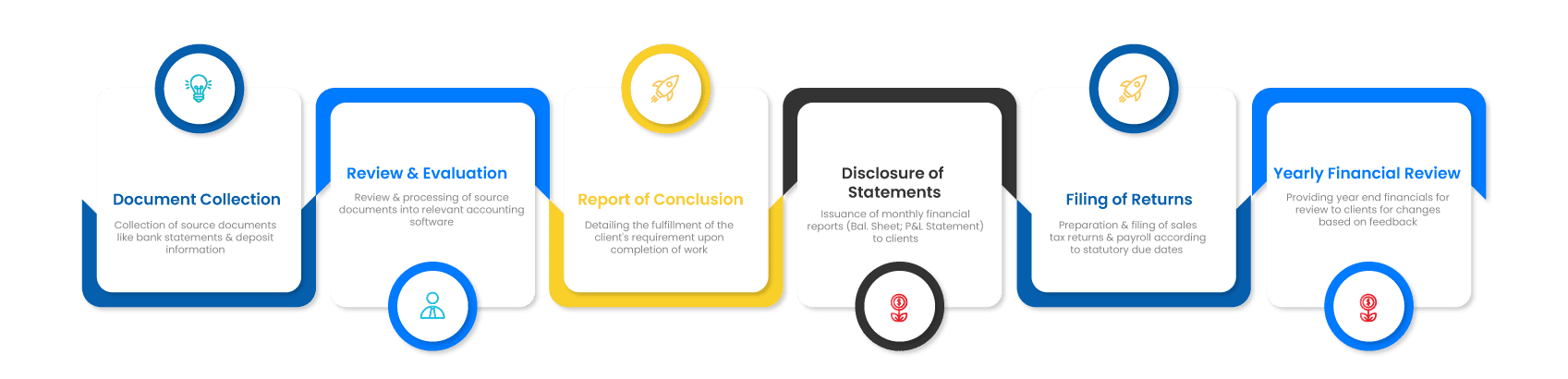

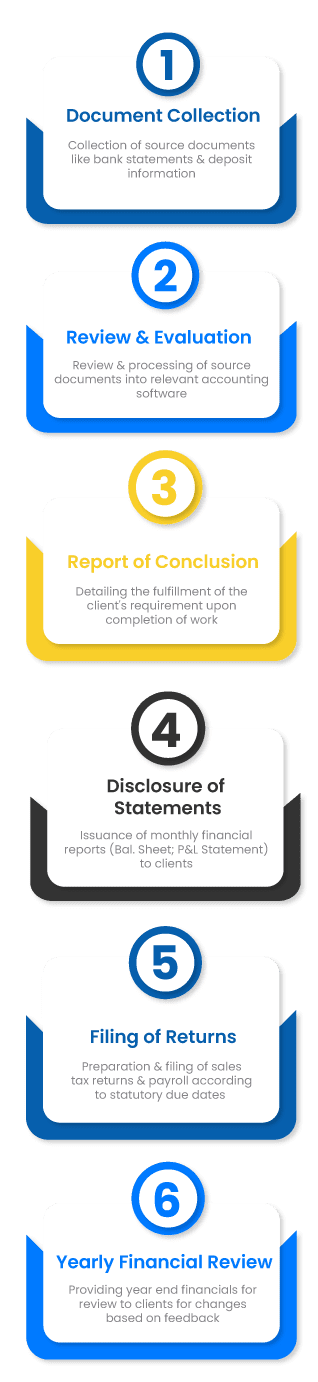

Benefit from Our Systematic Approach

Payroll Calculation

Reconciliation of Benefits

Compliance Expertise

Tax Management

Address the Intricacy of Payroll Calculations with Expert Services

Outsourced Bookkeeping eases the burden of employers and takes complete responsibility as a payroll management service provider.

Our payroll management services eliminate the burdensome task of allocating salaries with effective and skillful handling. This way the chances of errors are reduced, employees are satisfied, and your business achieves cost efficiency.

Partnering with the best payroll service company is easy! Book a Meeting to explore our comprehensive online payroll service and let our experts handle your payroll seamlessly.

Request a Free Quote

Partner with Outsourced Bookkeeping for Fully Managed Best Payroll Services!

Utilize Professional Services for Excellent Payroll Management

Outsourced Bookkeeping has been in the accounting business for 20+ years providing payroll management services for small businesses, big companies, and CPA firms. Our team is well-versed in managing payroll ensuring you receive outstanding service.

We know that shortcomings in payroll management can reduce the credibility of an employer among the employees. On the other hand, compensation is what keeps the employees motivated to deliver their best work.

At Outsourced Bookkeeping, our payroll service small business solutions combine advanced technology with expert support. Whether you’re a small startup or an established company, our tailored solutions ensure you get the best payroll service at an affordable cost.

Testimonials

What Our Clients Say

Larry Garnick

Jim Adkinson

Simon Frost

Step by Step Real Estate Accounting

Comprehensive Data Management - Payroll Services for Financial Progress

Laws and regulations are crucial for payroll processing and Outsourced Bookkeeping gives utmost importance to them. We realize that payroll management is more than just a basic function. Our services are focused on meeting regulatory standards such as FSLA (the Fair Labor Standards Act).

We are certified professionals who take care of all factors in your payroll cycle such as Social Security, Medical Insurance, Federal Income Taxes, and State Income Taxes. This protects your business from business uncertainty and gives you a clear insight.

We are certified professionals who take care of all factors in your payroll cycle such as Social Security, Medical Insurance, Federal Income Taxes, and State Income Taxes. This protects your business from business uncertainty and gives you a clear insight.

Ready to simplify your payroll? Discover why we’re the best payroll service company for small businesses. Contact us today!

Outsourced Bookkeeping

Frequently Asked Questions

Online payroll services are cloud-based systems that help businesses manage payroll tasks like calculating wages, withholding taxes, and ensuring compliance. They are especially beneficial for small businesses by saving time, reducing errors, and streamlining payroll processes from any location.

Look for payroll service providers that offer flexibility, ease of use, strong customer support, and cost-effectiveness. Consider providers like Square Payroll, Paychex, and Intuit for user-friendly and budget-friendly options. Ensure the service includes features you need, like direct deposit, tax filing, and integration with accounting software.

Full-service payroll providers handle all aspects of payroll, from calculating and distributing paychecks to managing taxes and compliance. Many also offer HR tools, employee self-service portals, and detailed reporting, which make payroll more manageable for small and large businesses alike.

Yes, payroll services are available for businesses of all sizes, including those with a single employee. Outsourcing can simplify payroll for small teams, ensuring compliance and allowing you to focus on growing your business.

Outsourcing payroll services saves time, reduces errors, and ensures compliance with changing tax laws. It also allows you to access expert payroll support and avoid costly mistakes. For small businesses, outsourced payroll can be a cost-effective solution.

Yes, many payroll service providers offer budget-friendly options for small businesses. Providers like Square Payroll and Intuit Payroll offer basic plans that are affordable and customizable, making it easier for businesses to manage payroll without breaking the bank.

Payroll service software should be user-friendly, secure, and capable of handling tax filings, benefits, and compliance. Look for software that integrates with other tools you use, such as accounting software, and offers reliable customer support.

Yes, many payroll service providers offer customer support specifically for small businesses. Options like Square Payroll and Intuit Payroll have dedicated support teams to assist with setup, troubleshooting, and ongoing payroll needs.

Yes, many payroll service companies provide local support options. Additionally, many online payroll services offer virtual support, so you can receive assistance no matter where your business is located.

Construction payroll services specialize in handling payroll needs unique to the construction industry, including managing union benefits, certified payroll requirements, and varying work hours. They ensure compliance with industry-specific regulations and simplify payroll for construction businesses.

Yes, global payroll services are available for businesses that employ workers in multiple countries. These services ensure compliance with different national tax laws and payroll regulations, making it easier to manage a global workforce.

Paychex offers comprehensive payroll solutions with features like tax filing, employee self-service, benefits integration, and a mobile app. It’s highly rated for its ease of use and customer support, making it ideal for small and large businesses alike.