Generating value in the economy while creating jobs and revenues are the ultimate aim of every business in the world. America is at the forefront of value creation and entrepreneurs are innovation oriented individuals. Building on a groundwork of hard work and ideas, American entrepreneurs are talk of the town. Every business brings a fresh […]

Accounting activities are indispensable to any organization. It is a routine activity required to be carried out throughout the year without fail. The process of recording the financial activities enables the organization to ensure the financial stability of the business. Often it is significant to some financial institutions to portray an accurate picture of the […]

Working through a maze of numbers and financial transactions is a task of arduous nature. It requires time, resources and skills of highest order to calibrate the business in a proper order. Working through tons of documents and information in order to facilitate the smooth running of business operation is the core aspect of a […]

Not very long ago, when she left her job as a law firm manager. Laura Lee Sparks knew it from the very early that she cannot handle all the tasks for her startup. So she got into hiring an outside bookkeeper and delegate the finance and accounting activities to the virtual team. In this way, […]

Christmas is around the corner and the New Year 2018 beckons with a new found wave of optimism. Economy is on the upturn and America is now the centre of economic growth. Small firms and Business needs the continuous focus on the financial activities to keep track of the growth and set out the trends. […]

In the recent days, outsourcing revolutionizes the approach of doing business. The change in the business scenario is due to the latest industrial change. Truly speaking outsourcing is certainly a blessing to the business community to avail the great benefits of technology and infrastructure as a whole. The Evolution: Yes, it is a gradual process, […]

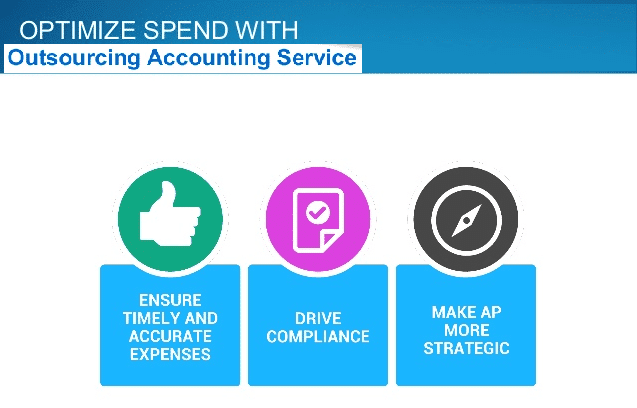

Landscape of business is strewn with innovation backed companies thriving on growth and success. Business firms are on the hunt for new avenues of revenue based upon core ideas of efficiency. Small business understand the importance of streamlining their operations while riding a wave of growth. Requirements for a successful finance and accounting outsourcing: Critical […]

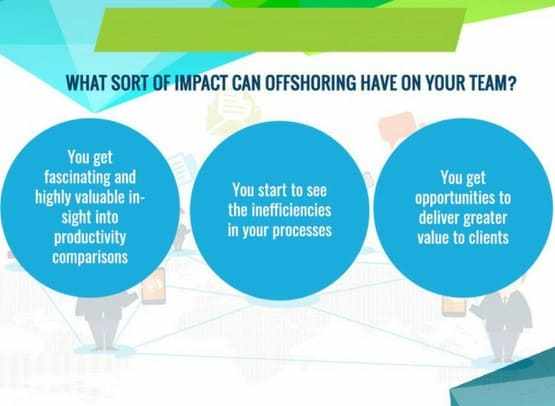

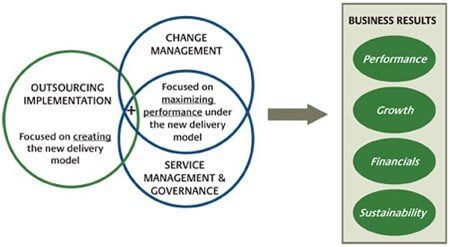

The intended benefits of outsourcing services as known to everyone are improved capabilities, organizational focus, cost reduction, and many more. However, there are lots of things involved in it. You can lower your operating cost By taking help of this seamless accounting services. Yes, the transition from traditional accounting service to outsourcing implementation obviously puts […]

Success is going to elude you if you underestimate the significance of governance in outsourcing and change management. To minimize the risk of outsourcing risk-sharing contracts are also there to save your interest. Every entrepreneur adopts the process of outsourcing with a view to getting some benefits. However, they fail to attain those outsourcing advantages […]

The core aim of every business entrepreneur is to reduce their company’s overhead costs while maximizing profits. Further, these business houses put efforts in complying the regulatory requirements needed for the business at the same time. The best advice to do so is to take the advantages of an expert help to enjoy the increase […]